Allbirds

2021 | Principles and Methods of User Research | MDes Project

Instructor: Mark Micheli | Team: Alison Chiu, Yong Shan Lee, Ann Vogel, Amy Zazadzinski, myself

IIT Institute of Design

Allbirds, a New Zealand-American sustainable shoe and apparel company, was our fictional client for this user research study. Our team of five conducted primary and secondary research into Allbirds’ customer motivations, how their brick-and-mortar stores compare to the online experience, and recommendations for their brand in international markets.

Allbirds is on a mission to “create better things in a better way.”

CEOs Tim Brown and Joey Zwillinger launched Allbirds in 2016 with a focus on simplicity, comfort, and natural materials. (Allbirds)

Allbirds is a New-Zealand-American company with headquarters in San Francisco, CA.

According to LinkedIn, org structure includes C-Suite, SVP, VP, to Director levels with design and UX likely under CTO Benny Joseph. (LinkedIn)

Going Public & Financial State

Allbirds filed for an IPO on August 31, 2021, hoping to “help pioneer a framework for companies to conduct what we are calling a sustainable public equity offering.” (Financial Times)

Allbirds raised $100M in Series E funding, with the company value totaling $1B. (Financial Times)

Digital channel represented 89% of sales with retail sales declining. (WSJ)

Differentiation

Vertical Retail: Allbirds claims it is a “vertical retailer, meaning it can control its own inventory and product flow.” (WSJ)

Expanding Product Line: Recently announced they plan to sell wool and tree-based athletic clothing (WSJ)

Sustainable Mission: Using carbon-neutral and carbon-negative materials sets it apart from typical sneaker companies. (MarketWatch)

Casualization: With minimal brand styling, Allbirds’s casual shoe design benefits from the blending of home, work, gym. (MarketWatch)

Key Challenges

Supply Chain: Climate change and raw materials sourcing were issues due to COVID

Profitability: Balancing new product introduction with customer habits and returns

Competition: Footwear is highly competitive, new sustainable competitors arise

TOp Level Summary

Heuristic Evaluation

With a large percentage of profit from online purchases, the Allbirds website underwent a heuristic evaluation to understand and compare elements of usability.

Overall, the site ranked at 1.1 (where 0 suggests there is little need for improvement, and 4 suggests there are major usability concerns). The largest issue present was Help users recognize, diagnose, and recover from errors wherein error messages should be expressed in plain language (no codes), precisely indicate the problem, and constructively suggest a solution. The Chat feature isn’t clearly marked as a help function, it’s minimal design makes it easily missed by the user.

Think-Alouds

Think-alouds for usability involve participants thinking aloud, literally, as they are performing a set of specified tasks. Participants were asked to say whatever came into their mind as they complete a task for the Allbirds’ website. This includes what they are looking at, thinking, doing, and feeling.

Task: Buy a gift card

“It isn't so obvious where gift cards would be. I mean, I was able to find them just on a guess. But I don't necessarily think that gift cards should be listed under men. Nor should it be listed under women, it's a little confusing.”

— Participant 1

Task: Find the nearest store location*

“These seem to be ordered in a very arbitrary way that might be you know, specific to the flagship store, or the company, but there's no way for me to know, especially without them being alphabetized, which one is closest to me in this format. I think that the pictures are cute, but I really could have done without the pictures . . . I would prefer to look up based off of zip code.”

— Participant 2

*Note: Since performing this task in October 2021, Allbirds has updated their stores tab to include a map.

Task: Choose and item from the product page

“I'm usually more interested in looking at a picture in an environment other than just the white background. And this more like an Urban Outfitters. I can see the pictures already zoomed . . . if I'm looking right now to the socks I will probably try to zoom in although in the beginning I saw these four pictures on the left.”

— Participant 3

Observation

To understand how users actually behave when shopping, our team visited physical a Allbirds store in Chicago, IL. We observed the information displayed to shoppers, questions and behaviors of shoppers, and how the service staff responded.

Top 5 Observations

Customer Loyalty: People who came in wearing Allbirds shoes were more likely to make a purchase.

Shopping Streak: The majority of people who visited the store were carrying shopping bags from other nearby stores.

Customer Apparel: People visiting the store typically wore baseball caps, leggings, shorts, and other athletic apparel similar to what Allbirds sells.

Tactile Experience: People take advantage of their ability to touch the product materials in store.

Staff Picks: The store employees were conscientious about recommending Allbirds products to customers based on their own positive experiences.

Survey

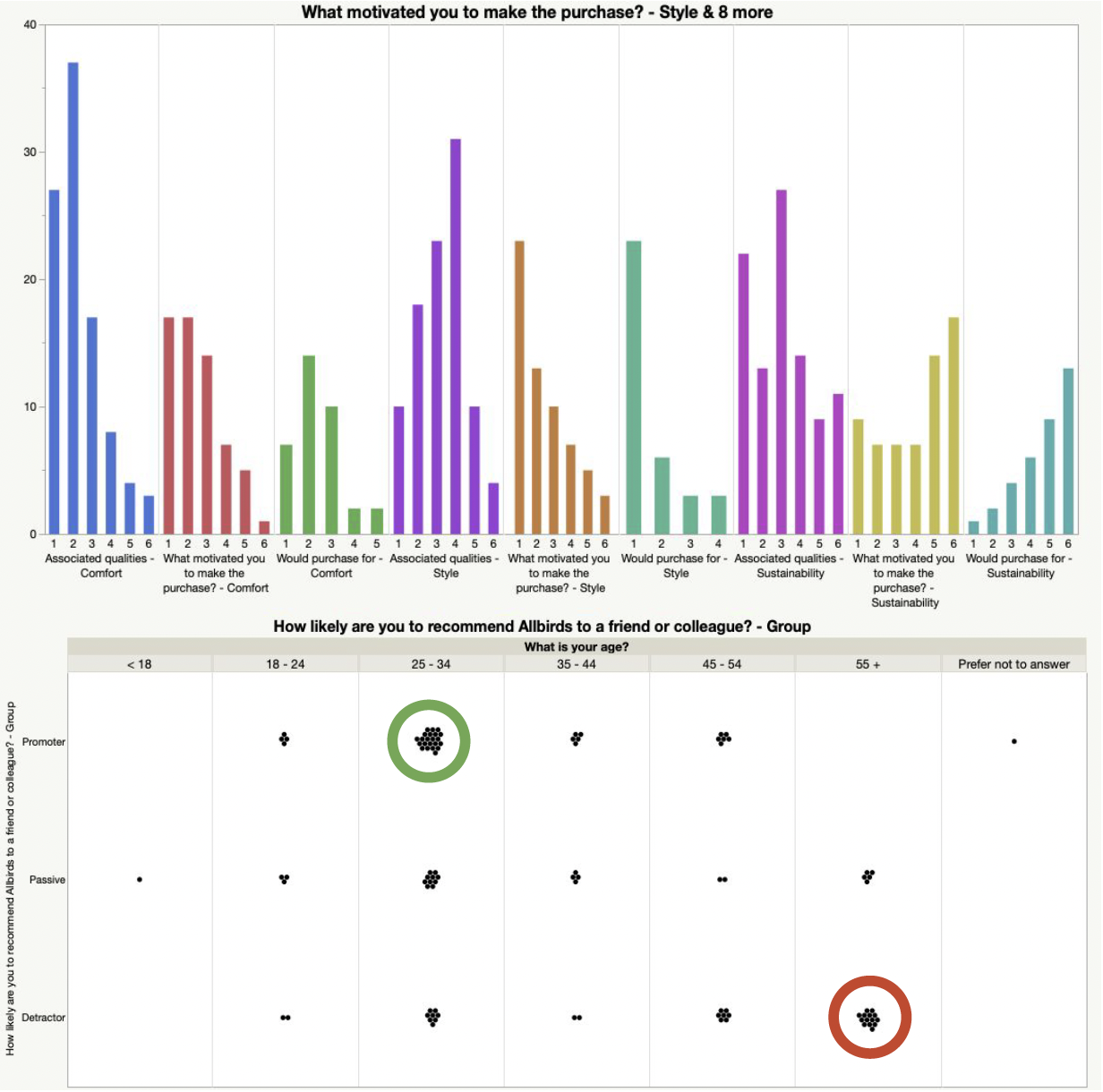

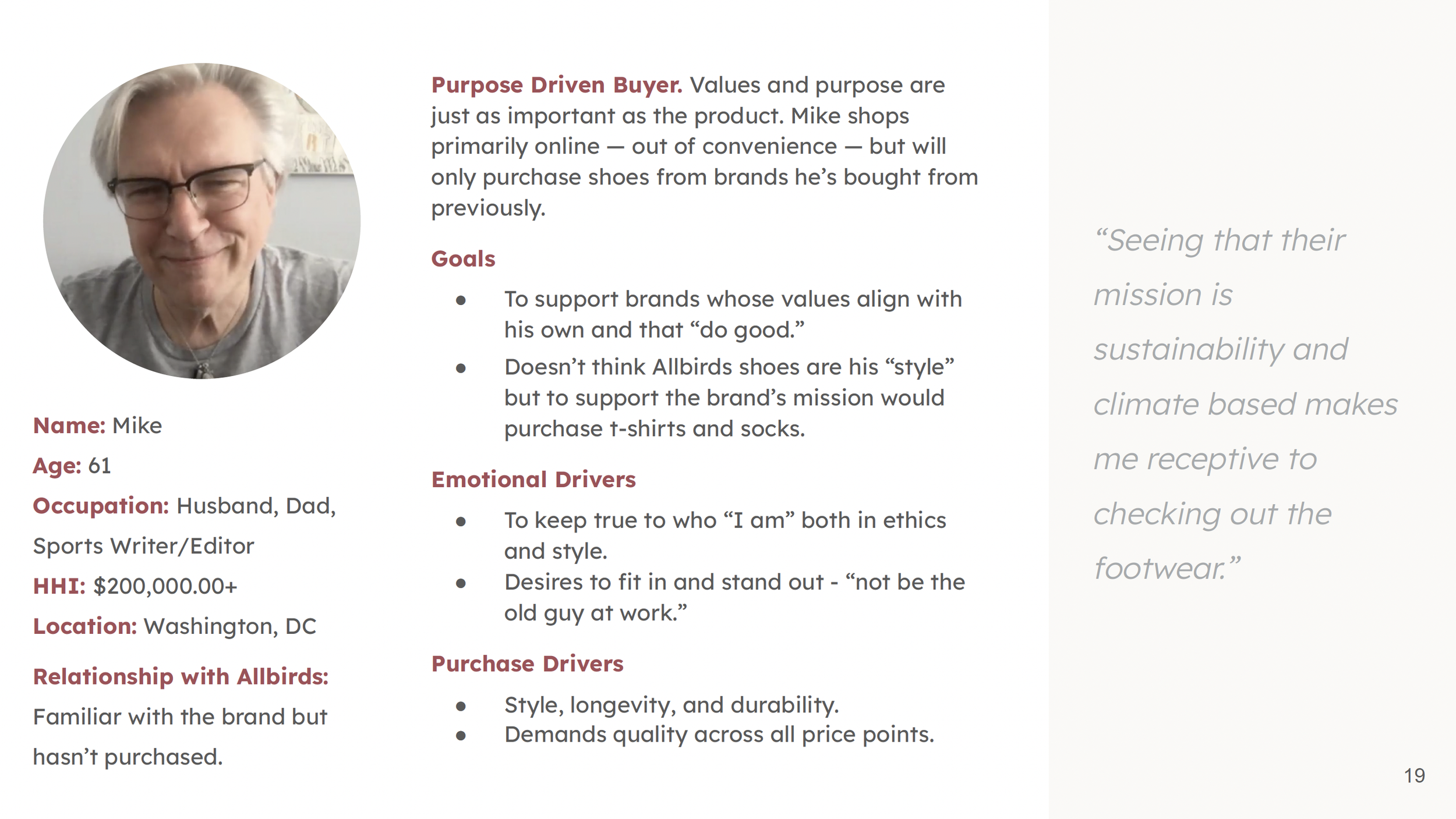

Using a survey, we we sought to develop a broad understanding of the current Allbirds customer and their experience with the brand and its products. We looked to gain insight into the motivators, drivers, and perceptions of Allbirds from those who are familiar with but have not purchased from the brand.

The survey was created on Qualtrics, shared on Reddit, Facebook, and MTurk; and the audience likely skewed 35 and younger.

The survey received 95 responses: 62% identified as female, 37% male, 1% non-binary, 41% Millennial, 57% middle to upper-middle class income range.

High-Level Insights:

Frequent, Engaged Customers. A majority of customers own more than one Allbirds item. Nearly half of all respondents (48.33%) have purchased 1 - 2 items within the past year, followed by 3 - 5 items (38.33%) and 6 or more items (13.33%). While it is unknown whether customers are purchasing new or familiar items, purchasing customers appear invested in the products and brand.

Insider Knowledge. Nearly half (46.67%) are familiar with the Allbirds pins. These pins are given for free when purchasing an item in store, or when a customer asks the staff directly. While not explored within this survey, it would be interesting to note how many different pins a customer has, and if they attempted to collected each store location’s unique city pin.

Positive Brand Image. In general, respondents would recommend Allbirds to a friend (NPS = 4.21). However, this score is lower than expected based on the positive feedback respondents expressed throughout the survey.

Customer Experience: The respondents who made purchases from Allbirds had an overwhelmingly positive experience, with 58.3% saying Extremely Satisfied and 35% saying Somewhat Satisfied. Customers felt positive about their Allbirds experience due to the politeness and passion of the staff; and the speed in which ordering issues were resolved.

Perception vs Reality. Comfort was a consistent top value and association among prior and potential customers. Style held low association with the brand, however, the top motivation to purchase for prior and potential customers. Lastly, Sustainability held a strong association with their brand but a low and extremely low motivation to purchase for prior customers and potential customers, respectively.

Ignored Audience. As described earlier, the NPS score was lower than expected. The NPS primarily showed promoters within the 25-34 age bracket and detractors in the 55+ bracket, suggesting there are issues present with older customers.

In-Home Interviews & Card Sorting

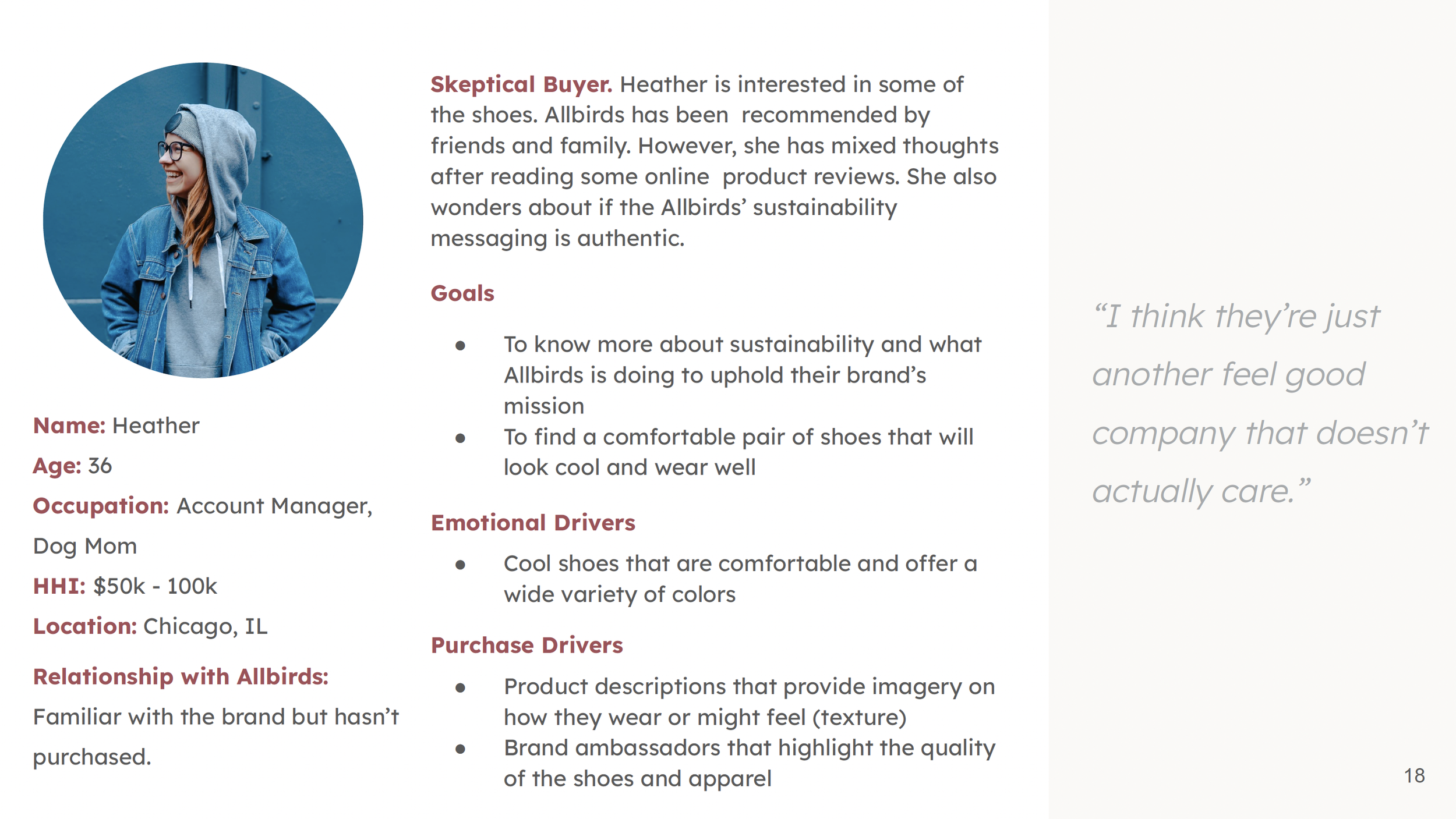

To learn more about why people would or would not purchase Allbirds, we conducted in-depth interviews in their homes and via Zoom where we asked people to tell us about their closets, clothes, and shopping preferences. The second half of these sessions involved a card sorting exercise in which people could rank various factors relating to shopping habits.

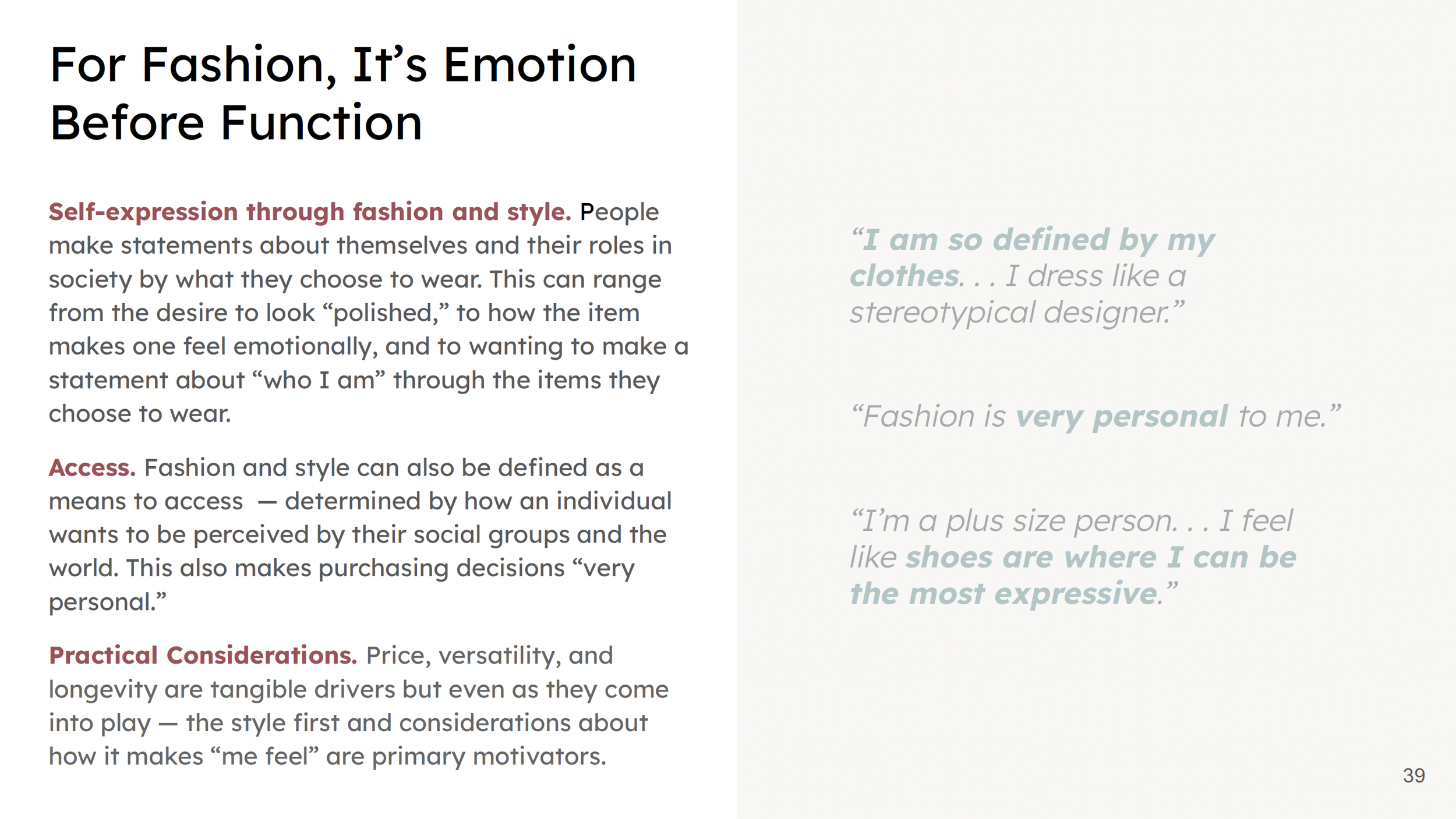

Shopping is Personal

“I have to be happy when I get dressed, that’s so important!”

While interviewees were diverse in demographics and lifestyle, there was a strong common theme – fashion and style are “very personal.” There is an emotional element to shopping and choosing items to purchase. Reminders of family, friends, childhood, nostalgia, and home came into play.

Style as Social Expression

“(I wear) mainly black, I am a designer that’s what we wear.”

The emotional drivers here can range from wanting to look or be thought of in a certain way, professional for work to show that you’re able to lead teams, or to let the world know you are part of a group. People make statements about themselves and their roles in society by what they choose to wear.

Versatility, Longevity, Affordability

“I want to know it was worth the investment."

The ability to be worn with many “outfits” and across the different parts of their lives – work, school, and social are important. But factoring how often and how long an item can be worn against price appears to be a way to justify spend. For some the idea of “treating” yourself or the perceived benefits of a product are enough to override the ROI.

The ideal shopping experience. A sensorial, in-store experience where customers can touch the products and materials, and become familiar with the brand’s quality and degree of comfort.

Discovery and inspiration. For interviewees, whether online or in-store, the ability to discovery or be inspired are key to creating a good experience.

While important, not a priority. Sustainable fashion is important, but isn’t a main priority and the knowledge is mostly gained through friends. An industry standard would be nice so that the information is easier to understand.

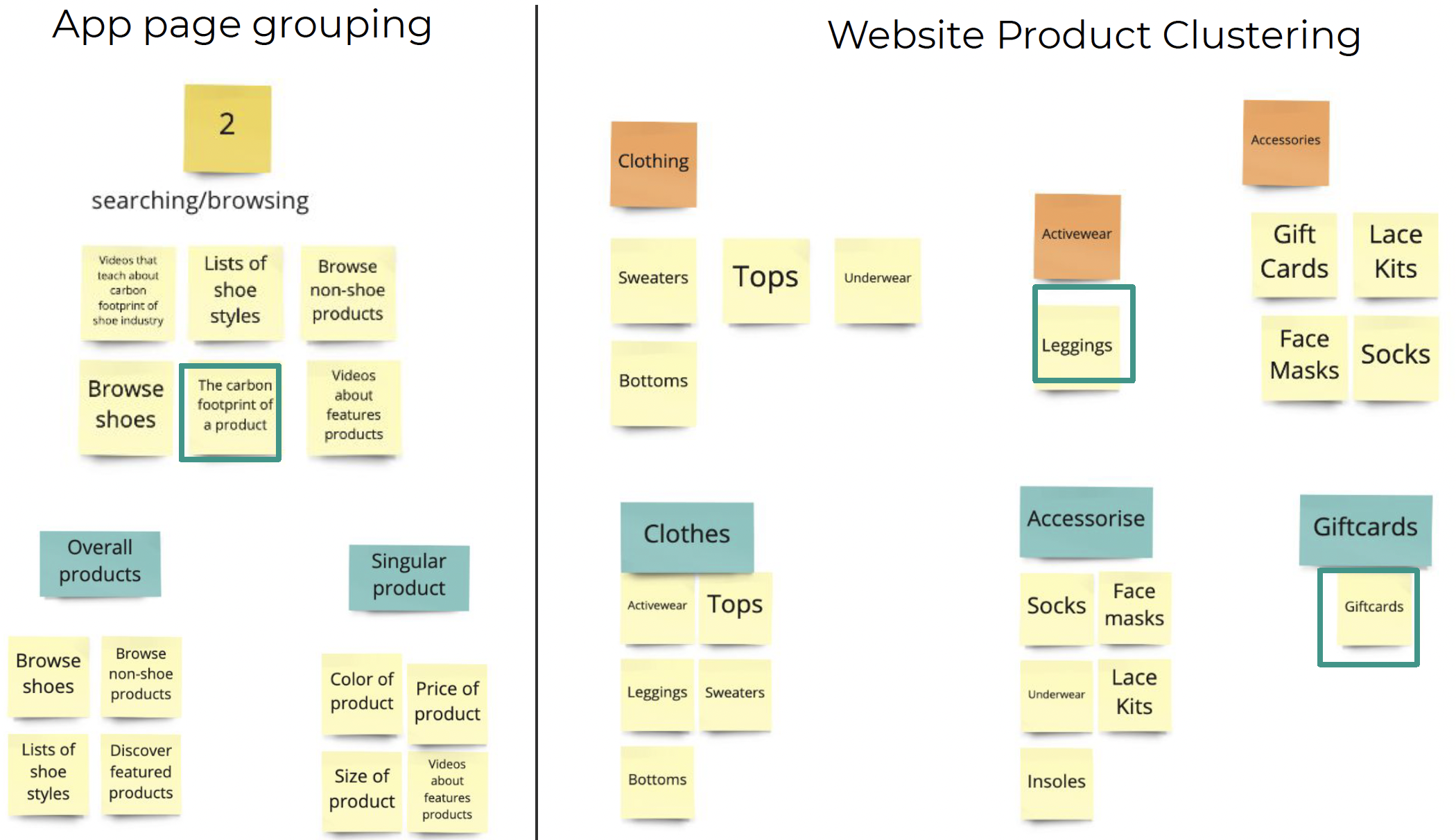

The card sorting revealed some differences in the mental models that the interviewees had about what information they want to see about a product at once, and how different products should be organized on the website.

One interviewee deemed it very important to know about the sustainability of the products as she is shopping, and that the sustainability info should be accessible throughout the shopping process. Another interviewee simply wanted the product info and nothing else crowding it.

For product sorting, one interviewee thought activewear should be separate from other apparel, whereas another interviewee put all the clothes together, but had a separate category for gift cards

Sensemaking & Storytelling Frameworks

The frameworks shown were based on the initial research and observations of Allbirds users. They act as tools to make design decisions and define critical themes as it relates to their customers.

Empathy Map

Empathy maps describe the state of mind of the customer and shed light on the information they take in during an experience. This is ideal as Allbirds is opening several stores and learning how customers think, feel, and act in-store will be pivotal to understanding what makes a brick and mortar store successful.

The completed empathy map shows that the majority of customers observed are millennial women who have knowledge of Allbirds through online platforms and may make their decision based on the try-on process in-store.

5 E’s

The 5 E’s document the customer experience as they start and end their journey. This was chosen because Allbirds has shown to have issues with web navigation.

The framework breaks down what was observed from various Allbirds’ touchpoints: store, web, app, and social media. The framework shows they could enhance their exit and extend experiences.

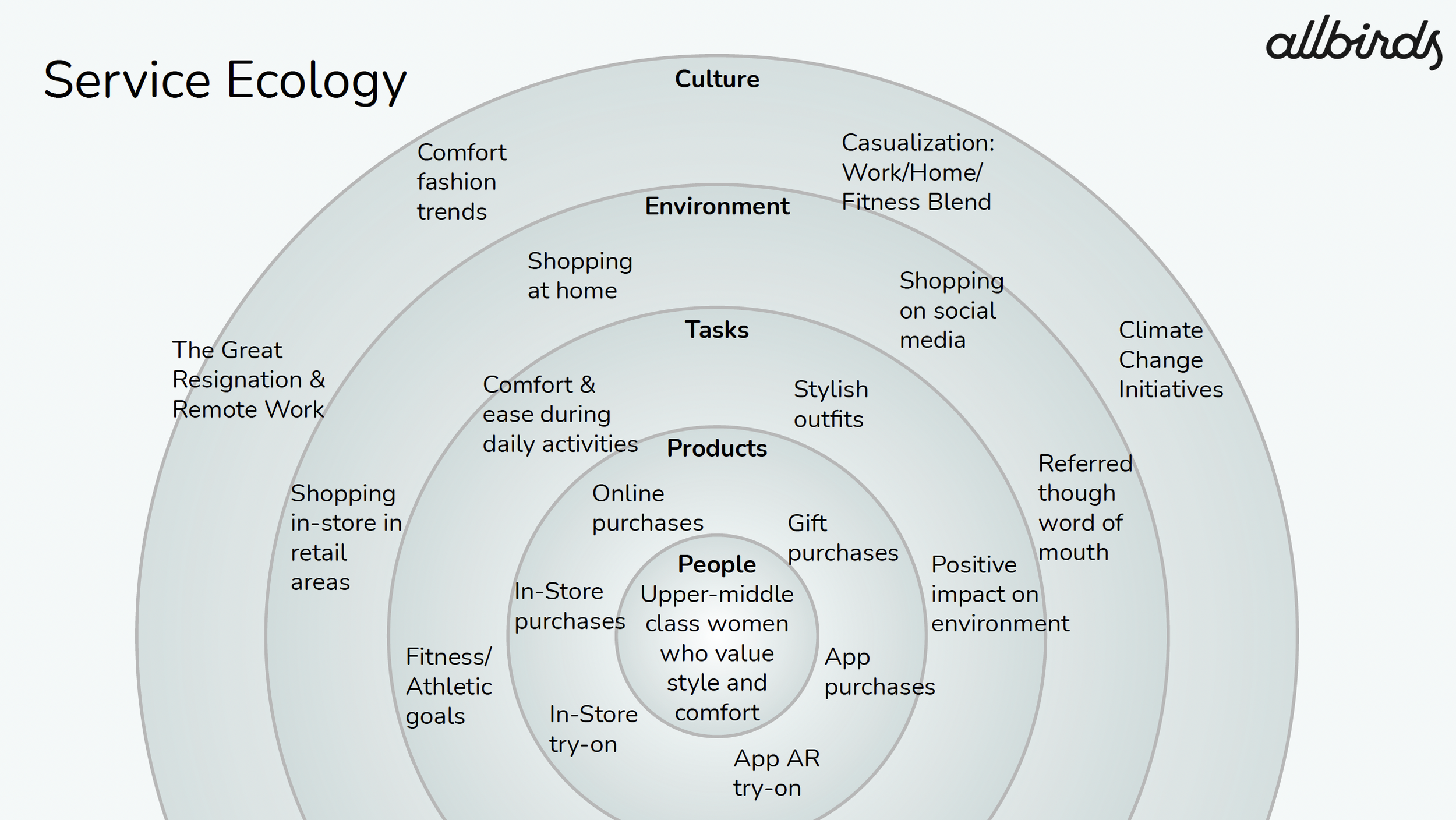

Service Ecology

The service ecology helps understand interconnected interaction for product and service experiences. It can provide context to how Allbirds customers engage with their products and within their own worlds.

The ecology suggests that customers value their outward appearance to the world more than the intrinsic value of the Allbirds products. Allbirds could capitalize on this by enhancing their color, material, finishes to reflect the styles which their customers like to be seen wearing.

Summary Deck

With all the information gathered, our team created a summary deck of our research findings and recommendations for Allbirds.